electronics-journal.com

08

'20

Written on Modified on

Increased market share for Industrial Ethernet – fieldbus decline continues and wireless stays stable

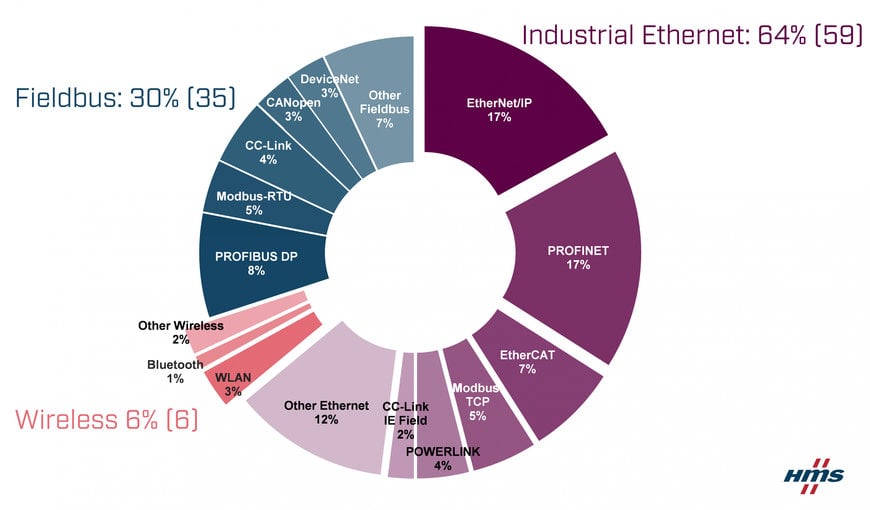

Industrial network market shares 2020 according to HMS Networks

Market shares 2020 according to HMS Networks – fieldbus, industrial Ethernet and wireless

Industrial network connectivity for devices and machines is key to achieve smart connected factories. HMS Networks annual study of the industrial network market shows that Industrial Ethernet increases its market share to 64% of new installed nodes (59% last year), while fieldbuses drop to 30% (35). The leading networks EtherNet/IP and PROFINET share first place at 17% each. Wireless technologies stay at a 6% market share.

HMS Networks presents its annual analysis of the industrial network market, focusing on new installed nodes within factory automation globally. As an independent supplier of solutions for industrial communication and the Industrial Internet of Things, HMS has a substantial insight into the industrial network market. The 2020 study includes estimated market shares for fieldbuses, industrial Ethernet, and Wireless. Estimated growth rates are not included this year, the reason being the unique general market conditions due to the Coronavirus situation.

Increased market share for industrial Ethernet, while fieldbuses continue to drop

In the study, HMS concludes that Industrial Ethernet continues to take market share from fieldbuses. Industrial Ethernet now makes up for 64% of the global market of new installed nodes in Factory Automation (compared to 59% last year). EtherNet/IP and PROFINET share first place at 17% market share each. EtherCAT continues to perform well globally at 7%, and Modbus-TCP at 5% just passes Ethernet POWERLINK at 4%.

Fieldbus market shares continue to drop

HMS estimates a fieldbus decline to 30% of new installed nodes (compared to a 35% last year). PROFIBUS is still number one at 8%, for the first time accounting for less than 10% of the total industrial network market. Runners up are Modbus-RTU at 5%, followed by CC-Link at 4%.

Reflections on the market shares for industrial Ethernet and fieldbuses

“We expect the industrial network market to grow steadily during the coming years, but due to the unique Corona virus situation which is now affecting the general business conditions globally, we have chosen not to include growth numbers in our 2020 analysis, only market shares”, says Anders Hansson, Chief Marketing Officer at HMS Networks. “So, only focusing on market shares this year, we see that Industrial Ethernet continues to drive industrial connectivity in factories, headed by EtherNet/IP and PROFINET with EtherCAT in third place.” Hansson continues: “PROFIBUS is still the biggest fieldbus but has lost market share as the general decline for fieldbuses continues. Another interesting finding is that Modbus keeps doing well - both when it comes to fieldbus Modbus RTU as well as the Ethernet-based Modbus-TCP, indicating that factories do not refrain from using well-working technologies in their new installations just because they have been around for some time.”

Wireless stays stable, looking good for the future

Wireless technologies keep a 6% market share, with WLAN still being the most popular technology, followed by Bluetooth. “Wireless keeps its market share on a growing market which is not bad, but we expect the Wireless share to increase over time,” says Anders Hansson. “With all ongoing activities globally about wireless cellular technologies (e.g. Private LTE/5G networks) as enablers for next-level smart manufacturing, market demand will increase for wirelessly connected devices and machines to be included in the less cabled and flexible automation architectures of the future”.

Regional network variations

EtherNet/IP and PROFINET are leading in Europe and the Middle East with PROFIBUS and EtherCAT as runners up. Other popular networks are Modbus (RTU/TCP) and Ethernet POWERLINK. The US market is dominated by EtherNet/IP with EtherCAT gaining some market share. PROFINET and EtherNet/IP lead a fragmented Asian market, followed by PROFIBUS, EtherCAT, Modbus (RTU/TCP), and CC-Link/CC-Link IE Field.

Industrial network connectivity for devices and machines is key to achieve smart connected factories. HMS Networks annual study of the industrial network market shows that Industrial Ethernet increases its market share to 64% of new installed nodes (59% last year), while fieldbuses drop to 30% (35). The leading networks EtherNet/IP and PROFINET share first place at 17% each. Wireless technologies stay at a 6% market share.

HMS Networks presents its annual analysis of the industrial network market, focusing on new installed nodes within factory automation globally. As an independent supplier of solutions for industrial communication and the Industrial Internet of Things, HMS has a substantial insight into the industrial network market. The 2020 study includes estimated market shares for fieldbuses, industrial Ethernet, and Wireless. Estimated growth rates are not included this year, the reason being the unique general market conditions due to the Coronavirus situation.

Increased market share for industrial Ethernet, while fieldbuses continue to drop

In the study, HMS concludes that Industrial Ethernet continues to take market share from fieldbuses. Industrial Ethernet now makes up for 64% of the global market of new installed nodes in Factory Automation (compared to 59% last year). EtherNet/IP and PROFINET share first place at 17% market share each. EtherCAT continues to perform well globally at 7%, and Modbus-TCP at 5% just passes Ethernet POWERLINK at 4%.

Fieldbus market shares continue to drop

HMS estimates a fieldbus decline to 30% of new installed nodes (compared to a 35% last year). PROFIBUS is still number one at 8%, for the first time accounting for less than 10% of the total industrial network market. Runners up are Modbus-RTU at 5%, followed by CC-Link at 4%.

Reflections on the market shares for industrial Ethernet and fieldbuses

“We expect the industrial network market to grow steadily during the coming years, but due to the unique Corona virus situation which is now affecting the general business conditions globally, we have chosen not to include growth numbers in our 2020 analysis, only market shares”, says Anders Hansson, Chief Marketing Officer at HMS Networks. “So, only focusing on market shares this year, we see that Industrial Ethernet continues to drive industrial connectivity in factories, headed by EtherNet/IP and PROFINET with EtherCAT in third place.” Hansson continues: “PROFIBUS is still the biggest fieldbus but has lost market share as the general decline for fieldbuses continues. Another interesting finding is that Modbus keeps doing well - both when it comes to fieldbus Modbus RTU as well as the Ethernet-based Modbus-TCP, indicating that factories do not refrain from using well-working technologies in their new installations just because they have been around for some time.”

Wireless stays stable, looking good for the future

Wireless technologies keep a 6% market share, with WLAN still being the most popular technology, followed by Bluetooth. “Wireless keeps its market share on a growing market which is not bad, but we expect the Wireless share to increase over time,” says Anders Hansson. “With all ongoing activities globally about wireless cellular technologies (e.g. Private LTE/5G networks) as enablers for next-level smart manufacturing, market demand will increase for wirelessly connected devices and machines to be included in the less cabled and flexible automation architectures of the future”.

Regional network variations

EtherNet/IP and PROFINET are leading in Europe and the Middle East with PROFIBUS and EtherCAT as runners up. Other popular networks are Modbus (RTU/TCP) and Ethernet POWERLINK. The US market is dominated by EtherNet/IP with EtherCAT gaining some market share. PROFINET and EtherNet/IP lead a fragmented Asian market, followed by PROFIBUS, EtherCAT, Modbus (RTU/TCP), and CC-Link/CC-Link IE Field.

Anders Hansson, Chief Marketing Officer, HMS Industrial Networks

Scope:

The study includes HMS’ estimation for 2020 based on number of new installed nodes in 2019 within Factory Automation. A node is defined as a machine or device connected to an industrial network. The presented figures represent HMS’ consolidated view, considering insights from colleagues in the industry, our own sales statistics and overall perception of the market.